White Paper: Unlocking Commercial Finance for the Off-Grid Solar PAYG Industry

Last year, a team representing Lighting Global, GOGLA and Data Consultancy Impact Lab was awarded the Finance for Resilience Award at the Bloomberg New Energy Finance Summit in New York. Aiming to help unlock commercial finance for the pay-as-you-go industry globally, the team set out to develop harmonized metrics, data sharing and benchmarking for the distributed solar companies. More recently, the team published a paper on financing for PAYG jointly with BNEF, SunFunder and the Fire Awards Secretariat.

Over a billion people lack access to electricity. That’s 1/6 of the globe that can’t do their homework at night or keep their business open after dark. Pay-as-you-go solar companies are the start-up community’s proposed answer to the challenge. Mobisol and SolarKiosk received the ‘Energy Pioneer Awards’ in 2016, and both can show an impressive customer growth through this very innovative business model approach. To scale, PAYG companies need debt capital. Lots of it.

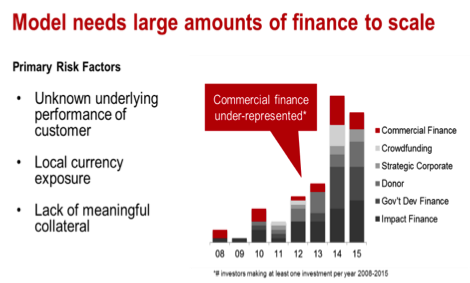

Over a billion people lack access to electricity. That’s 1/6 of the globe that can’t do their homework at night or keep their business open after dark. Pay-as-you-go solar companies are the start-up community’s proposed answer to the challenge. Mobisol and SolarKiosk received the ‘Energy Pioneer Awards’ in 2016, and both can show an impressive customer growth through this very innovative business model approach. To scale, PAYG companies need debt capital. Lots of it.However, high actual and perceived risk is limiting the amount of commercial capital deployed in the sector. While there is money and investor interest, it is not being deployed at the scale needed. This is largely due to lack of information about the credit quality of the off-taker, the thousands of families in rural areas of the world benefitting from these systems each month. This risk is truly unique to this sector; few other greenfield renewable energy investment faces the same risk.

Some operators are creating structured finance products to cut costs and address more potential investors:

Some operators are creating structured finance products to cut costs and address more potential investors:

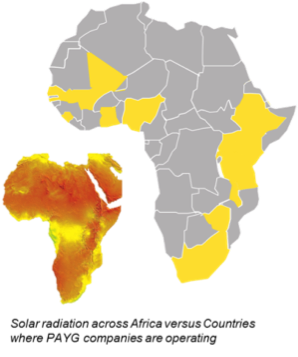

- Pay-as-you-go solar companies retail solar home systems to power basic appliances, primarily in East and West Africa. The systems are sold against a small upfront payment and regular ‘top-ups’, usually sent via low-cost mobile money services. The leading companies, including M-Kopa, Off-Grid Electric, d.Light, BBOXX, Nova Lumos and Mobisol, have raised more than $360m and serve about 700,000 customers – a microscopic fraction of the addressable market.

- After several years of early pilots, a number of these companies have now reached the stage at which they are seeking triple-digit million dollar amounts in debt capital to finance an accelerated roll-out of their services. Asset-backed debt vehicles are the primary candidate for this. But companies face the challenge of raising debt for an unproven industry and serving customers without a formal credit history.

- Many risks inherent in pay-as-you-go refinancing are far more pronounced than in conventional asset backed securities. These include currency risks, different tenor expectations and correlation risks arising from end-customers clustered in particular regions.

- Sector-wide harmonized portfolio performance metrics for pay-as-you-go companies will make possible a structured assessment of some of the largest risks. This will reduce transaction costs for investors assessing structured deals in the sector.

The KPIs are being finalized in February 2017, in parallel to the first structured deals in the pay-as-you-go sector that were agreed earlier in 2016. If successful, such financial vehicles can scale quickly. Residential solar securitization in the US rose from $53m to $803m in two years.

Read the full paper here and if you are interested in learning more, please contact Anna Lerner at alerner@worldbank.org.

Authors and contributors: Itamar Orlandi (Bloomberg New Energy Finance), Angus McCrone (Bloomberg New Energy Finance), David Battley (SunFunder), Nico Tyabji (SunFunder), James Falzon (Fire Awards Secretariat) and Anna Lerner (World Bank Group)